Amritsar 26 March 2022

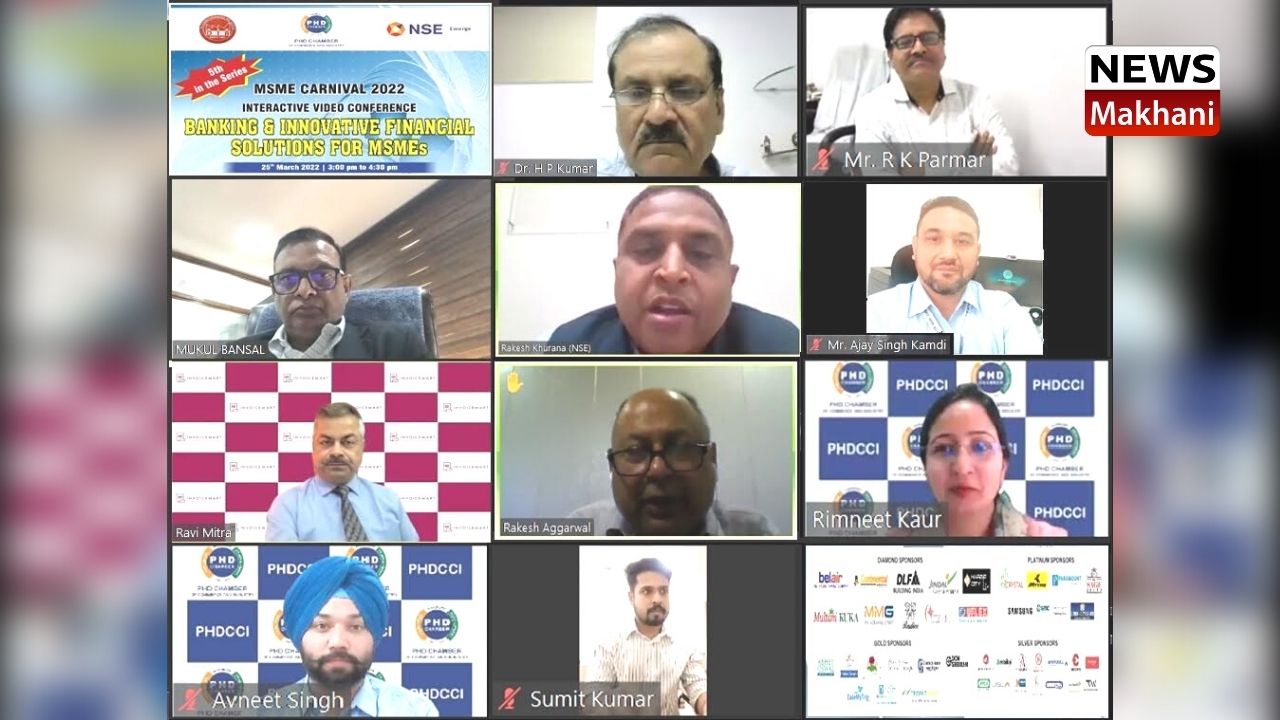

PHDCCI organises session on Banking and Innovative Financial Solutions for MSMEs Punjab State Chapter of PHD Chamber of Commerce & Industry organized fifth in the series under MSME Carnival Interactive session on Banking and Innovative Financial Solutions for MSMEs on 25 March 2022 to address issues an concerns of MSMEs in these challenging times.

Mr. Mukul Bansal, Convener, Banking & Financial Services Sub-Committee, Punjab State Chapter, PHDCCI & Chairman, Embee Financial Services Ltd. welcomed all the distinguished speakers and participants. While moderating the session, he stated that the MSME sector in India accounts for 99 percent of all registered businesses in the country. He added that the pandemic and lack of accessible funding has adversely impacted MSME sector. As a result, there is urgent need to address the delayed payment & ease of working capital for MSMEs.

Mr. S B Singh, Convener, MSME Sub-Committee, Punjab State Chapter & CEO, Taaran Industries Ludhiana while delivering his opening remarks stated that MSME sector is facing lot of issues due to increase in cost of raw materials; lower demand and also high cost of accessing finance. He mentioned Key constraints to MSME sector are Inadequate market linkages, lack of infrastructure, Inadequate Finance, Lack of Technology which affects their business growth.

Dr. H P Kumar, Former CMD, NSIC & Advisor, PHD Chamber said that one of the primary difficulties confronting the MSME sector was the lack of financial support from banks. To bridge the gap between banks and MSMEs, he suggested involving a credit rating agency to examine MSME Enterprises’ documentation and proposals, as well as assisting banks in determining the amount of capital to be granted and the rate of interest to be imposed correspondingly.

Mr. R K Parmar, Deputy Director, MSME DI- Ludhiana, Ministry of MSME, Government of India highlighted the importance of strengthening the MSME sector. He apprised participants on various Government schemes to support MSMEs &Startups. He pointed out the reason for difficulty in access to Credit for MSME enterprise was not been able to utilize & avail subsidies offered by Government through various schemes. He briefly explained use of MyMSME App & MSME SAMBANDH Portal.

Mr. Rakesh Khurana, Senior Manager, National Stock Exchange (NSE) highlighted the significance & process of listing the company on the National Stock Exchange and how launching an Initial Public Offering (IPO) can help to increase the Valuation of the Company.

Mr. Ravi Mitra, Regional Head, Business Development-North, A.TReDS Ltd. provided insights into Trade Receivables Discounting System (TReDS). He discussed Product Offerings: Factoring & Reverse Factoring, as well as its benefits for Buyers, MSME Seller & Financier. He explained TReDS is an online marketplace and is primarily focused on to make available cheap & timely finance to MSMEs to ease out their short term liquidity concerns.

Mr. Rakesh Rattan, General Secretary, Derabassi Industries Association, while delivering Vote of Thanks stated that the MSME sector bears a significant responsibility for industrial development. Restructuring and Technology upgradation is the need of the hour for the MSME Sector.

Participants comprising Industry members, MSMEs, Traders and Professionals from Pan India participated & benefited from the program.

हिंदी

हिंदी